5starsstocks.com Value Stocks: Your Ultimate Guide To Smart Investing

Welcome to the world of 5starsstocks.com value stocks, where smart investing meets strategic decision-making. If you've been searching for opportunities to grow your wealth through well-researched and high-potential stocks, you're in the right place. Our platform offers insights into value stocks that promise substantial returns while minimizing risks. Whether you're a seasoned investor or just starting out, understanding value stocks can be a game-changer in your investment journey.

Investing in stocks is much like embarking on a financial adventure, and with 5starsstocks.com value stocks, you're equipped with a reliable map. Value stocks are shares of companies that are believed to be undervalued in the market, offering a higher potential for growth compared to their current price. Our platform is designed to help you identify these opportunities, providing you with detailed analyses, up-to-date information, and expert recommendations to make informed investment decisions.

At 5starsstocks.com, we believe in empowering our users with knowledge and insights that are both actionable and trustworthy. Our value stocks listings are not just about numbers; they represent a comprehensive understanding of market trends, company performance, and future potential. By leveraging our resources, you can navigate the complexities of the stock market with confidence, ensuring that your investments are not only profitable but also aligned with your financial goals.

- Engaging Telugu Cinema A Deep Dive Into Sex Videos In Telugu

- Veronica Perasso Leaked A Comprehensive Analysis

Table of Contents

- What are Value Stocks?

- Why Invest in Value Stocks?

- How 5starsstocks.com Selects Value Stocks

- Criteria for Selecting Value Stocks

- Top Value Stocks on 5starsstocks.com

- Analyzing Company Performance

- Financial Ratios and Their Importance

- Market Trends Impacting Value Stocks

- Risk Management Strategies

- How to Start Investing in Value Stocks?

- Common Mistakes to Avoid

- Success Stories of Value Investors

- Frequently Asked Questions

- Conclusion

What are Value Stocks?

Value stocks are a class of stocks that trade for less than their intrinsic values. These stocks are characterized by their low price-earnings ratios, high dividend yields, and solid fundamentals that indicate potential for future growth. Unlike growth stocks, which are valued based on future earnings projections, value stocks are considered undervalued based on current financial performance and market conditions.

Investors often look for value stocks as a way to capitalize on market inefficiencies, buying shares at a discount and holding them until the market recognizes their true worth. This approach requires a keen understanding of financial statements, industry trends, and economic indicators to identify companies that are fundamentally sound but temporarily overlooked by the market.

The allure of value stocks lies in their potential for significant appreciation once the market corrects its undervaluation. Historically, value investing has been a successful strategy for many of the world's most renowned investors, including Warren Buffett and Benjamin Graham, who have built their fortunes by identifying and investing in undervalued companies.

Why Invest in Value Stocks?

Investing in value stocks offers several advantages that appeal to both novice and experienced investors. These benefits include:

- Potential for High Returns: As undervalued stocks reach their true market value, investors can enjoy substantial capital gains.

- Dividend Income: Many value stocks offer attractive dividend yields, providing a steady stream of income while you wait for stock appreciation.

- Reduced Risk: Value stocks are generally considered less volatile than growth stocks, offering a more stable investment option.

- Long-Term Growth: By investing in companies with strong fundamentals, you position yourself for sustained growth over time.

Furthermore, value investing aligns with the buy-and-hold strategy, encouraging investors to maintain a long-term perspective rather than chasing short-term market trends. This approach can lead to more disciplined investment decisions and better overall portfolio performance.

How 5starsstocks.com Selects Value Stocks

The process of selecting value stocks at 5starsstocks.com involves rigorous analysis and careful evaluation of various factors. Our team of experts uses a combination of quantitative and qualitative criteria to identify stocks with the highest potential for appreciation. Key steps in our selection process include:

- Financial Analysis: We examine key financial metrics such as price-to-earnings ratios, price-to-book ratios, and dividend yields to assess a company's value.

- Industry Research: Understanding the industry in which a company operates is crucial for identifying potential growth opportunities and risks.

- Economic Indicators: We consider macroeconomic factors that could impact a company's performance, including interest rates, inflation, and economic cycles.

- Management Evaluation: The quality of a company's management team is a critical factor in its ability to execute its business strategy and generate shareholder value.

By combining these elements, 5starsstocks.com provides investors with a curated list of value stocks that offer the best potential for long-term gains. Our platform is designed to be user-friendly, ensuring that investors of all experience levels can easily access and understand the information they need to make informed decisions.

Criteria for Selecting Value Stocks

When it comes to selecting value stocks, several criteria can help investors identify the most promising opportunities. These criteria include:

- Low Price-to-Earnings (P/E) Ratio: A low P/E ratio indicates that a stock is trading at a lower price relative to its earnings, suggesting potential undervaluation.

- High Dividend Yield: A high dividend yield can be a sign of a stable company with consistent cash flow, making it an attractive choice for income-focused investors.

- Strong Balance Sheet: Companies with low debt levels and healthy cash reserves are better positioned to weather economic downturns and capitalize on growth opportunities.

- Consistent Earnings Growth: A history of consistent earnings growth demonstrates a company's ability to generate profits and sustain its business model.

By focusing on these criteria, investors can increase their chances of selecting value stocks that offer both stability and growth potential. Additionally, conducting thorough research and staying informed about market trends can help investors make more informed decisions and optimize their investment portfolios.

Top Value Stocks on 5starsstocks.com

5starsstocks.com offers a curated list of top value stocks that have been thoroughly analyzed and vetted by our team of experts. These stocks represent companies with strong fundamentals, attractive valuations, and promising growth prospects. Some of the top value stocks currently featured on our platform include:

- Company A: Known for its robust financial performance and competitive advantage in the market, Company A is a top pick for value investors.

- Company B: With a strong dividend yield and a solid balance sheet, Company B offers both income and growth potential.

- Company C: A leader in its industry, Company C has consistently delivered strong earnings and is well-positioned for future growth.

- Company D: With a low P/E ratio and a history of innovation, Company D is an attractive option for value-seeking investors.

Each of these companies has been selected based on rigorous analysis and in-depth research, ensuring that they meet the high standards of our platform. By investing in these top value stocks, you can benefit from the potential for significant long-term gains while minimizing risks.

Analyzing Company Performance

To effectively evaluate value stocks, analyzing company performance is essential. This involves assessing various financial and non-financial factors to determine a company's overall health and potential for future growth. Key areas of focus include:

- Revenue and Profitability: Examining a company's revenue growth and profit margins provides insights into its ability to generate income and control costs.

- Cash Flow Management: A company's ability to manage its cash flow is crucial for maintaining operations and funding future growth initiatives.

- Operational Efficiency: Analyzing key performance indicators such as inventory turnover and asset utilization can reveal how efficiently a company operates.

- Market Position: Understanding a company's competitive position within its industry can help assess its potential for sustaining growth and profitability.

By thoroughly analyzing these factors, investors can gain a comprehensive understanding of a company's performance and make informed decisions about whether to invest in its value stocks.

Financial Ratios and Their Importance

Financial ratios are critical tools for evaluating the financial health and performance of a company. They provide valuable insights into a company's operations, profitability, and overall stability. Some of the most important financial ratios for assessing value stocks include:

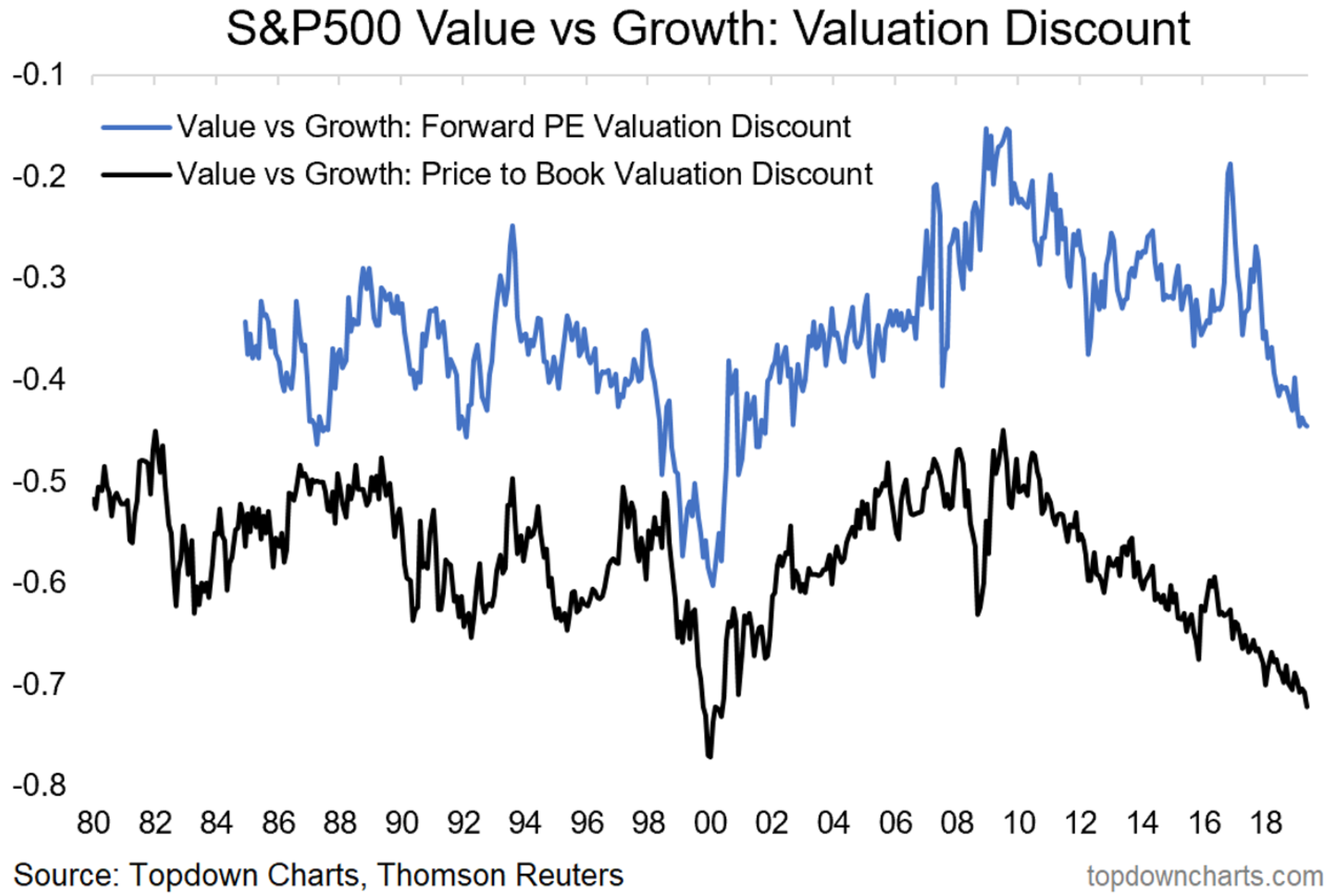

- Price-to-Earnings (P/E) Ratio: This ratio compares a company's current share price to its earnings per share, providing insights into its valuation and growth prospects.

- Price-to-Book (P/B) Ratio: The P/B ratio compares a company's market value to its book value, indicating whether a stock is undervalued or overvalued.

- Debt-to-Equity Ratio: This ratio measures a company's financial leverage, indicating the proportion of debt used to finance its assets.

- Return on Equity (ROE): ROE measures a company's profitability relative to its equity, providing insights into its ability to generate returns for shareholders.

By analyzing these financial ratios, investors can gain a deeper understanding of a company's financial position and make more informed decisions about investing in its value stocks.

Market Trends Impacting Value Stocks

Value stocks are influenced by various market trends that can impact their performance and investment potential. Understanding these trends is crucial for making informed investment decisions. Some of the key market trends impacting value stocks include:

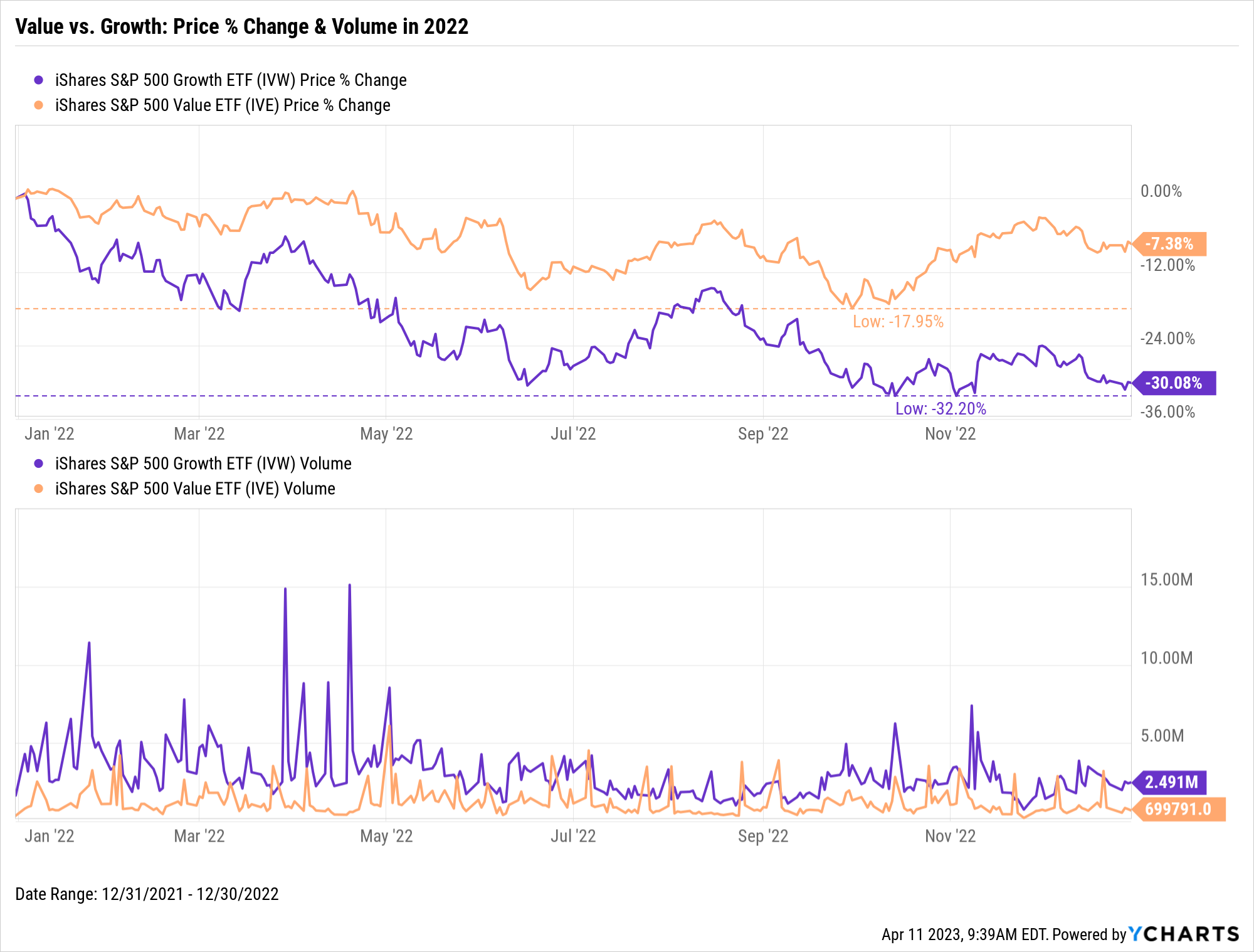

- Economic Cycles: The performance of value stocks often correlates with economic cycles, with some sectors performing better during economic expansions and others during recessions.

- Interest Rates: Changes in interest rates can affect the valuation of value stocks, as higher rates can impact borrowing costs and consumer spending.

- Inflation: Inflation can erode purchasing power and impact corporate profits, influencing the performance of value stocks.

- Technological Advancements: Technological innovations can disrupt industries and create new investment opportunities for value stocks.

By staying informed about these market trends, investors can better anticipate potential impacts on value stocks and adjust their investment strategies accordingly.

Risk Management Strategies

Investing in value stocks requires effective risk management strategies to protect your portfolio and maximize returns. Some key risk management strategies for value investors include:

- Diversification: Diversifying your portfolio across different sectors and asset classes can help mitigate risks and reduce volatility.

- Asset Allocation: Allocating your investments based on your risk tolerance and financial goals can help optimize your portfolio's performance.

- Stop-Loss Orders: Implementing stop-loss orders can limit potential losses by automatically selling a stock when its price falls below a predetermined level.

- Regular Portfolio Review: Regularly reviewing your portfolio can help identify underperforming stocks and make necessary adjustments to your investment strategy.

By incorporating these risk management strategies, investors can enhance their ability to navigate the uncertainties of the stock market and achieve their financial objectives.

How to Start Investing in Value Stocks?

Starting your journey in value investing requires careful planning and preparation. Here are some steps to help you get started:

- Educate Yourself: Learn about value investing principles, financial analysis, and market trends to build a solid foundation of knowledge.

- Define Your Investment Goals: Determine your financial goals, risk tolerance, and investment timeline to guide your investment strategy.

- Research Potential Stocks: Use resources like 5starsstocks.com to identify value stocks that align with your investment criteria.

- Open a Brokerage Account: Choose a reputable brokerage platform to facilitate your stock purchases and manage your portfolio.

- Start Small: Begin with a small investment to gain experience and build confidence before committing larger amounts of capital.

By following these steps, you can embark on your value investing journey with confidence and set yourself up for long-term financial success.

Common Mistakes to Avoid

Investing in value stocks can be rewarding, but it's essential to avoid common mistakes that can hinder your success. Some of these mistakes include:

- Not Conducting Thorough Research: Failing to thoroughly research potential investments can lead to poor decision-making and financial losses.

- Chasing Short-Term Gains: Focusing on short-term market fluctuations can distract from long-term investment goals and lead to impulsive decisions.

- Overlooking Risk Management: Neglecting risk management strategies can expose your portfolio to unnecessary risks and volatility.

- Ignoring Market Trends: Failing to stay informed about market trends can impact your ability to make informed investment decisions.

By avoiding these common mistakes, you can enhance your value investing strategy and increase your chances of achieving your financial goals.

Success Stories of Value Investors

Value investing has a rich history of success, with many investors achieving substantial wealth by identifying and investing in undervalued companies. Some notable success stories include:

- Warren Buffett: Known as the "Oracle of Omaha," Warren Buffett built his fortune by investing in undervalued companies with strong fundamentals and long-term growth potential.

- Benjamin Graham: Often referred to as the "father of value investing," Benjamin Graham's investment philosophy laid the foundation for modern value investing practices.

- Peter Lynch: As the former manager of the Magellan Fund, Peter Lynch achieved exceptional returns by identifying undervalued stocks with promising growth prospects.

- John Templeton: A pioneer in global investing, John Templeton successfully identified undervalued stocks in international markets, achieving impressive returns for investors.

These success stories demonstrate the power of value investing and serve as inspiration for investors seeking to achieve similar financial success through disciplined and strategic investment practices.

Frequently Asked Questions

- What is the difference between value and growth stocks?

- How can I identify undervalued stocks?

- Is value investing suitable for beginners?

- What are the risks of value investing?

- How often should I review my value stock portfolio?

- Can value stocks provide a reliable income stream?

Value stocks are typically undervalued and offer potential for appreciation based on current financial performance, while growth stocks are valued based on future earnings projections.

Identifying undervalued stocks involves analyzing financial ratios, company performance, and market trends to assess a stock's intrinsic value relative to its market price.

Yes, value investing can be suitable for beginners, especially those willing to adopt a long-term perspective and conduct thorough research before making investment decisions.

Value investing carries risks, including market volatility, changes in economic conditions, and the potential for misjudging a stock's true value.

Regularly reviewing your portfolio, at least quarterly, allows you to assess performance, identify underperforming stocks, and make necessary adjustments to your investment strategy.

Yes, many value stocks offer attractive dividend yields, providing a reliable income stream for investors in addition to potential capital gains.

Conclusion

Investing in 5starsstocks.com value stocks offers a unique opportunity to capitalize on undervalued companies with strong growth prospects. By leveraging expert insights and in-depth analysis, our platform empowers investors to make informed decisions and optimize their investment portfolios. Whether you're a seasoned investor or new to the world of value investing, understanding the principles and strategies outlined in this guide can help you achieve your financial goals and build long-term wealth.

As you embark on your value investing journey, remember to stay informed about market trends, conduct thorough research, and implement effective risk management strategies. By taking a disciplined and strategic approach, you can navigate the complexities of the stock market with confidence and success.

We invite you to explore the top value stocks on 5starsstocks.com and discover the potential for significant returns while minimizing risks. With the right knowledge and resources, you can unlock the power of value investing and achieve financial success.

- Indepth Look Into Aditi Mistry On Onlyfans A Rising Star

- Breaking News Nisha Gurgain Sex Video Scandal Rocks The Internet

The Value Of Value Stocks Seeking Alpha

Deep Value Stocks 2024 Lynea Rosabel