Ultimate Guide To 5starsstocks.com Value Stocks: Your Path To Smart Investing

At 5starsstocks.com, we prioritize equipping investors with the knowledge and tools necessary to identify undervalued companies with strong fundamentals. Our focus is on providing in-depth analyses, expert insights, and actionable tips to help you navigate the complex world of value investing. This comprehensive guide will cover everything from the basics of value stocks to advanced strategies for maximizing your returns. By exploring our platform, you’ll gain access to a wealth of resources designed to enhance your understanding of value stocks and their potential impact on your investment strategy. Our goal is to empower you with the confidence and expertise needed to make smart investment choices and ultimately achieve your financial goals. So, let’s dive into the world of 5starsstocks.com value stocks and discover the opportunities that await. ## Table of Contents 1. What Are Value Stocks? 2. Why Invest in 5starsstocks.com Value Stocks? 3. How to Identify Value Stocks? 4. The Role of Market Trends in Value Investing 5. Analyzing Financial Statements for Value Investing 6. Key Metrics for Evaluating Value Stocks 7. Common Mistakes in Value Investing and How to Avoid Them 8. How Do Economic Indicators Affect Value Stocks? 9. Diversification Strategies with 5starsstocks.com Value Stocks 10. How to Use Technology in Value Investing? 11. Case Studies: Successful Value Stock Investments 12. FAQs About 5starsstocks.com Value Stocks 13. Conclusion: Your Roadmap to Successful Value Investing 14. External Resources for Further Learning 15. FAQs ## What Are Value Stocks?

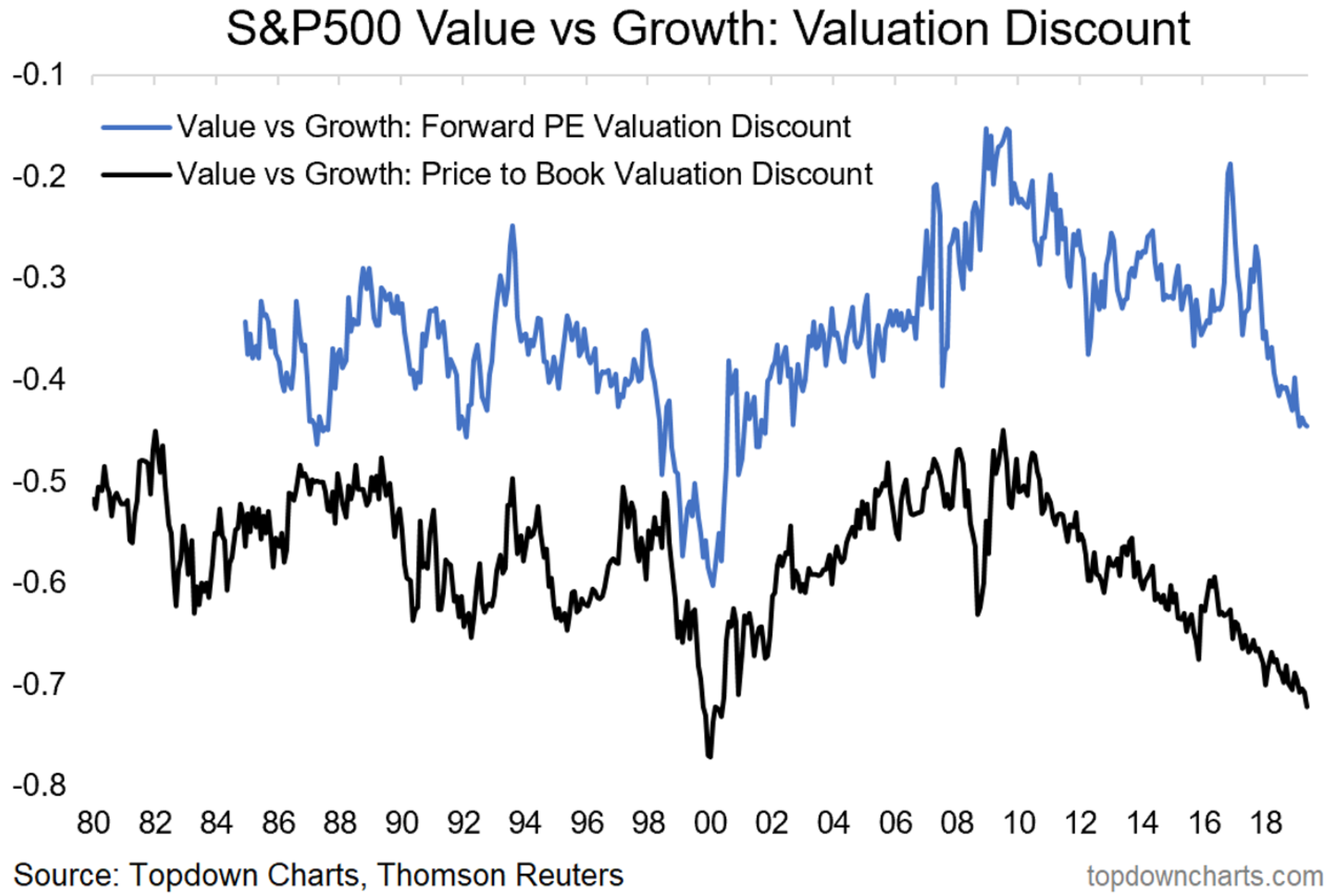

Value stocks are shares of a company that appear to be undervalued based on fundamental analysis. These stocks have a low price-to-earnings ratio (P/E), a low price-to-book ratio (P/B), and often offer high dividend yields. Unlike growth stocks, which are valued for their potential future earnings, value stocks are typically considered bargains in the stock market due to their current trading price being lower than the company's intrinsic value.

Investors who are interested in value stocks focus on finding companies that are temporarily undervalued in the market but have strong fundamentals. This means that the company has the potential to grow in value over time, providing investors with significant returns when the market eventually recognizes the company's true worth. Value investing is often associated with a contrarian approach, where investors go against the market trend to find hidden gems.

- Telugu Saree Sex A Cultural Exploration Of Attire And Identity

- Indepth Insight Into The Art Of Filmmaking Full Sexy Video Open

One of the most renowned advocates of value investing is Warren Buffett, who has consistently emphasized the importance of investing in companies with strong fundamentals at a discounted price. By understanding what value stocks are and how they fit into your investment strategy, you can effectively build a diversified portfolio that balances risk and reward.

## Why Invest in 5starsstocks.com Value Stocks?

Investing in 5starsstocks.com value stocks offers a multitude of benefits for both novice and experienced investors. The platform is designed to provide comprehensive insights and analyses to help you make informed investment decisions. Here are a few reasons why you should consider investing in value stocks through 5starsstocks.com:

- Desi Mms Clips A Comprehensive Analysis And Cultural Impact

- Intriguing Details About Anjli Aroras Life And Work

- Expert Insights: 5starsstocks.com offers expert analyses and insights that help you identify undervalued stocks with strong growth potential. Our team of financial experts uses proven methodologies to analyze market trends and company fundamentals.

- Robust Tools: The platform provides a range of tools and resources that make it easier for you to evaluate potential investments. These include stock screeners, financial statement analyses, and valuation calculators.

- Diversification Opportunities: By investing in value stocks, you can diversify your portfolio across different sectors and industries, reducing risk while maximizing potential returns.

- Long-term Growth: Value stocks, by nature, are positioned for long-term growth as the market eventually realizes their true worth. This can lead to substantial capital gains for patient investors.

- Community Support: Join a community of like-minded investors who share insights, tips, and strategies. Engaging with other investors can provide additional perspectives and enhance your investment knowledge.

By leveraging the resources and tools available on 5starsstocks.com, you can confidently navigate the complexities of value investing and work towards achieving your financial objectives.

## How to Identify Value Stocks?

Identifying value stocks requires a keen understanding of fundamental analysis and the ability to recognize undervalued companies in the market. Here are some key steps to help you identify value stocks:

- Analyze Financial Statements: Review a company’s financial statements, including the balance sheet, income statement, and cash flow statement, to assess its financial health and performance.

- Evaluate Key Metrics: Focus on key valuation metrics such as the price-to-earnings ratio (P/E), price-to-book ratio (P/B), and dividend yield to determine if a stock is undervalued.

- Assess Industry Trends: Understand the broader market and industry trends to identify sectors that may offer value investment opportunities.

- Consider Management Quality: Evaluate the company’s management team and their track record in executing business strategies and delivering shareholder value.

- Look for Competitive Advantages: Identify companies with strong competitive advantages, such as brand strength, unique products, or cost leadership, which can drive long-term growth.

By following these steps, you can effectively identify value stocks that offer the potential for significant returns over time. Remember, thorough research and due diligence are critical components of successful value investing.

## The Role of Market Trends in Value Investing

Market trends play a crucial role in value investing, as they can significantly impact the performance of value stocks. Understanding these trends allows investors to make informed decisions and capitalize on opportunities. Here are some ways market trends influence value investing:

- Economic Cycles: Economic cycles affect various industries differently. During economic downturns, value stocks may become more attractive as investors seek stability and consistent dividends.

- Interest Rates: Changes in interest rates can impact the cost of borrowing and influence corporate earnings. Value stocks may perform better in a rising interest rate environment due to their established business models and steady cash flows.

- Inflation: Inflation can erode purchasing power and impact consumer spending. Companies with pricing power and strong fundamentals are better positioned to weather inflationary pressures.

- Technological Advancements: Technological changes can disrupt industries and create new opportunities for value investors. Identifying companies that adapt to technological advancements can lead to successful investments.

By staying informed about market trends and understanding their impact on different industries, you can strategically position your investment portfolio to capitalize on value opportunities.

## Analyzing Financial Statements for Value Investing

Analyzing financial statements is a fundamental aspect of value investing. It provides insights into a company's financial health, performance, and potential for future growth. Here’s how you can effectively analyze financial statements for value investing:

- Balance Sheet: Review the balance sheet to assess the company’s assets, liabilities, and shareholder equity. Look for a healthy balance between debt and equity and sufficient liquidity to cover short-term obligations.

- Income Statement: Analyze the income statement to understand the company's revenue, expenses, and profitability. Focus on trends in revenue growth, operating margins, and net income.

- Cash Flow Statement: Evaluate the cash flow statement to determine the company’s ability to generate cash from operations. Positive cash flow from operations is a sign of financial stability.

- Ratio Analysis: Use financial ratios such as the current ratio, debt-to-equity ratio, and return on equity to assess the company’s financial performance relative to industry peers.

By performing a thorough analysis of financial statements, you can gain a deeper understanding of a company's financial position and identify potential value investment opportunities.

## Key Metrics for Evaluating Value Stocks

When evaluating value stocks, certain key metrics provide valuable insights into a company's valuation and growth potential. Here are some essential metrics to consider:

- Price-to-Earnings Ratio (P/E): The P/E ratio compares a company's current share price to its earnings per share (EPS). A low P/E ratio may indicate that a stock is undervalued.

- Price-to-Book Ratio (P/B): The P/B ratio compares a company's market value to its book value. A P/B ratio below 1 suggests that the stock may be undervalued.

- Dividend Yield: The dividend yield measures the annual dividend payment as a percentage of the stock’s current price. High dividend yields can be attractive to value investors seeking income.

- Debt-to-Equity Ratio: This ratio assesses a company’s financial leverage by comparing its total liabilities to shareholder equity. A lower ratio indicates a more financially stable company.

- Return on Equity (ROE): ROE measures a company’s ability to generate profit from shareholder equity. A higher ROE indicates efficient use of equity capital.

By focusing on these key metrics, investors can make informed decisions about which value stocks to include in their portfolios.

## Common Mistakes in Value Investing and How to Avoid Them

Value investing can be highly rewarding, but it also comes with its own set of challenges. Here are some common mistakes that investors make and tips on how to avoid them:

- Ignoring Market Trends: While value investing focuses on fundamentals, ignoring market trends can lead to missed opportunities. Stay informed about economic indicators and industry developments.

- Overlooking Management Quality: A company’s management team plays a crucial role in executing strategies and driving growth. Evaluate management’s track record and corporate governance practices.

- Chasing High Yields: High dividend yields can be enticing, but they may also indicate financial distress. Analyze the sustainability of dividend payments before investing.

- Lack of Diversification: Concentrating your portfolio in a few value stocks can increase risk. Diversify across sectors and industries to mitigate potential losses.

- Neglecting Long-term Perspective: Value investing requires patience and a long-term perspective. Avoid short-term market noise and focus on the company’s intrinsic value.

By being aware of these pitfalls and implementing strategies to avoid them, you can enhance your success in value investing.

## How Do Economic Indicators Affect Value Stocks?

Economic indicators provide valuable insights into the overall health of the economy and can significantly impact value stocks. Understanding these indicators allows investors to make informed decisions. Here are some key economic indicators to consider:

- Gross Domestic Product (GDP): GDP measures the total economic output of a country. A growing GDP indicates a healthy economy, which can positively impact corporate earnings and value stocks.

- Unemployment Rate: The unemployment rate reflects the percentage of the labor force that is unemployed. Lower unemployment rates generally lead to increased consumer spending and business activity.

- Inflation Rate: Inflation measures the rate at which the general level of prices for goods and services rises. Moderate inflation can benefit companies with pricing power, while high inflation can erode purchasing power.

- Interest Rates: Interest rates impact borrowing costs and consumer spending. Rising interest rates can affect companies with high debt levels, while low rates may stimulate economic growth.

By monitoring these economic indicators, investors can gain a better understanding of the macroeconomic environment and its influence on value stocks.

## Diversification Strategies with 5starsstocks.com Value Stocks

Diversification is a key strategy in value investing, as it helps mitigate risk and enhance potential returns. Here are some diversification strategies to consider with 5starsstocks.com value stocks:

- Sector Diversification: Invest in value stocks across different sectors and industries to spread risk and capitalize on various market opportunities.

- Geographic Diversification: Consider investing in value stocks from different geographic regions to reduce exposure to country-specific risks.

- Asset Class Diversification: Balance your portfolio by including other asset classes such as bonds, real estate, and commodities alongside value stocks.

- Time Diversification: Invest regularly over time to take advantage of market fluctuations and reduce the impact of short-term volatility.

By implementing these diversification strategies, you can build a resilient investment portfolio that is better equipped to weather market uncertainties.

## How to Use Technology in Value Investing?

Technology plays a pivotal role in modern value investing, offering tools and resources that enhance decision-making and streamline processes. Here’s how you can leverage technology in value investing:

- Stock Screeners: Use stock screeners to filter potential value stocks based on specific criteria such as P/E ratio, dividend yield, and market capitalization.

- Financial Analysis Software: Utilize financial analysis software to perform in-depth analyses of financial statements and company performance.

- Investment Research Platforms: Access investment research platforms for expert insights, market trends, and company analyses to inform your investment decisions.

- Automated Trading Platforms: Consider using automated trading platforms to execute trades efficiently and take advantage of market opportunities.

By embracing technology, investors can streamline their value investing processes, enhance decision-making, and gain a competitive edge in the market.

## Case Studies: Successful Value Stock Investments

Learning from successful value stock investments can provide valuable insights and inspiration for your investment journey. Here are a few case studies of successful value stock investments:

- Apple Inc.: Once considered a value stock due to its low P/E ratio and strong fundamentals, Apple has grown into a market leader, providing substantial returns to long-term investors.

- Berkshire Hathaway: Under the leadership of Warren Buffett, Berkshire Hathaway has consistently identified undervalued companies and achieved impressive growth through value investing principles.

- Johnson & Johnson: Known for its robust product portfolio and strong financials, Johnson & Johnson has been a staple in value investment portfolios, delivering steady returns over time.

By studying these case studies, you can gain insights into successful investment strategies and apply them to your own value investing journey.

## FAQs About 5starsstocks.com Value Stocks ### What makes 5starsstocks.com value stocks unique?

5starsstocks.com value stocks are unique due to their focus on providing comprehensive analyses and expert insights to help investors identify undervalued companies with strong growth potential. The platform offers a range of tools and resources to enhance your investment decision-making process.

### How can I start investing in value stocks through 5starsstocks.com?

To start investing in value stocks through 5starsstocks.com, sign up for an account on the platform, explore the available resources and tools, and begin researching potential investment opportunities. Utilize the platform’s stock screeners and financial analyses to make informed decisions.

### What are the risks associated with value investing?

Value investing entails risks such as market volatility, economic downturns, and company-specific challenges. It requires thorough research and a long-term perspective to mitigate these risks and achieve potential returns.

### Can I use value stocks for short-term trading?

Value stocks are generally better suited for long-term investments due to their focus on fundamental analysis and intrinsic value. Short-term trading of value stocks may not align with the principles of value investing.

### How do dividends factor into value investing?

Dividends play a significant role in value investing, as they provide a source of income and indicate a company’s financial health. High dividend yields can be attractive to value investors seeking consistent returns.

### What are some common value investing strategies?

Common value investing strategies include fundamental analysis, identifying undervalued stocks, focusing on dividend-paying companies, and maintaining a diversified portfolio. These strategies help investors build a balanced and resilient investment portfolio.

## Conclusion: Your Roadmap to Successful Value Investing

In conclusion, 5starsstocks.com value stocks offer a wealth of opportunities for investors seeking to build a robust investment portfolio. By understanding the principles of value investing, leveraging expert insights, and utilizing advanced tools, you can confidently navigate the complexities of the stock market and achieve your financial goals.

Remember to stay informed about market trends, perform thorough research, and maintain a long-term perspective to enhance your success in value investing. By following the strategies and insights outlined in this guide, you can embark on a rewarding investment journey and unlock the potential of 5starsstocks.com value stocks.

## External Resources for Further Learning

To further enhance your knowledge of value investing, consider exploring the following external resources:

- Investopedia: Introduction to Value Investing

- Wall Street Journal: Value Investing: A Primer

- Morningstar: What Is Value Investing?

## FAQs ### What is the difference between value stocks and growth stocks?

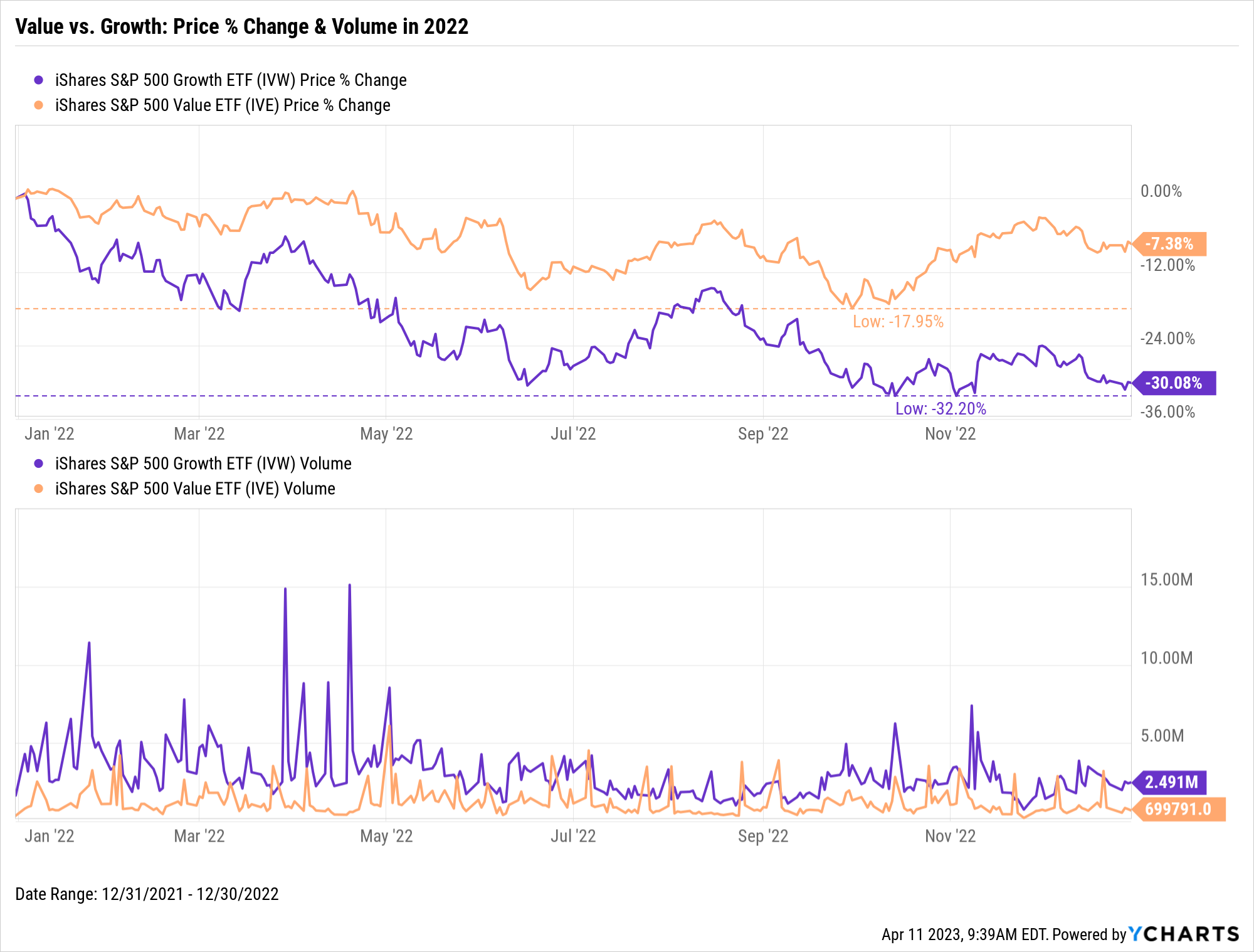

Value stocks are characterized by their low market valuation relative to fundamentals, while growth stocks are valued for their potential future earnings. Value stocks tend to offer stability and dividends, while growth stocks focus on capital appreciation.

### How often should I review my value stock portfolio?

It’s recommended to review your value stock portfolio periodically, such as quarterly or annually, to assess performance, market conditions, and the alignment of your investment goals. Regular reviews help ensure your portfolio remains balanced and aligned with your objectives.

### What impact do interest rates have on value stocks?

Interest rates can influence borrowing costs and corporate earnings. Rising interest rates may benefit value stocks with established business models and steady cash flows, while low rates can stimulate economic growth and positively impact market conditions.

### Can value stocks provide income through dividends?

Yes, many value stocks offer dividend payments, providing a source of income for investors. High dividend yields can be attractive to value investors seeking consistent returns alongside capital appreciation.

### How does 5starsstocks.com support investors in value investing?

5starsstocks.com supports investors by offering expert insights, comprehensive analyses, and a range of tools to identify undervalued companies with strong growth potential. The platform provides resources to enhance investment decision-making and build a diversified portfolio.

### What role does diversification play in value investing?

Diversification is essential in value investing, as it helps mitigate risk and enhance potential returns. By investing in a variety of sectors, industries, and asset classes, investors can create a resilient portfolio better equipped to weather market uncertainties.

- Sex Videos Telugu Insights And Understanding Of Cultural Influence

- Aditi Mistry Video Insights And Impact In The Digital World

The Value Of Value Stocks Seeking Alpha

Deep Value Stocks 2024 Lynea Rosabel