Ultimate Guide To 5starsstocks.com Dividend Stocks For Smart Investors

Investing in dividend stocks can be a game-changer for those looking to build a steady income stream and grow their wealth over time. 5starsstocks.com dividend stocks offer a platform for investors to explore a curated selection of stocks that pay dividends, providing valuable insights and strategies to maximize returns. As the market continues to evolve, dividend stocks remain a popular choice for investors seeking both income and capital appreciation. The key lies in understanding the nuances of these investments and making informed decisions based on comprehensive analysis and expert advice.

With 5starsstocks.com dividend stocks, investors gain access to a wealth of resources designed to help them navigate the complex world of dividend investing. From educational content to expert recommendations, this platform empowers both novice and seasoned investors to harness the potential of dividend stocks. As you delve into the world of dividend investing, it's essential to recognize the importance of a diversified portfolio and the role dividend stocks can play in achieving financial goals. By leveraging the tools and insights provided by 5starsstocks.com, investors can make informed decisions that align with their unique financial objectives.

In this comprehensive guide, we will explore the ins and outs of 5starsstocks.com dividend stocks, offering valuable insights and strategies to help you make the most of your investment journey. We'll delve into the benefits of dividend investing, key considerations for selecting the right dividend stocks, and tips for managing a successful dividend-focused portfolio. Whether you're just starting out or looking to refine your investment strategy, this guide will provide you with the knowledge and confidence needed to thrive in the world of dividend stocks.

- Subashree Sahu Xxx A Remarkable Influence In Industryfield

- Top Thrills A Deep Dive Into Hot Web Series Sensations

Table of Contents

- What Are Dividend Stocks?

- Why Invest in Dividend Stocks?

- Benefits of Dividend Stocks

- How Do Dividend Stocks Work?

- 5starsstocks.com Dividend Stocks Overview

- Choosing the Right Dividend Stocks

- What Are the Key Metrics for Evaluating Dividend Stocks?

- Risk Management in Dividend Investing

- How to Build a Diversified Dividend Portfolio?

- Tax Considerations for Dividend Stocks

- Top 5 Dividend Stocks on 5starsstocks.com

- Common Mistakes to Avoid in Dividend Investing

- Frequently Asked Questions

- Conclusion

What Are Dividend Stocks?

Dividend stocks are shares in companies that pay out a portion of their earnings to shareholders in the form of dividends. These payments can be made on a regular basis, such as quarterly, semi-annually, or annually, and are a way for companies to distribute profits to their investors. Unlike growth stocks, which primarily reinvest earnings back into the company to fuel expansion, dividend stocks provide a more immediate return to shareholders, making them an attractive option for income-focused investors.

Dividend stocks are typically associated with well-established companies that have a history of consistent earnings and stable cash flows. These companies often operate in mature industries where rapid growth is less likely, allowing them to allocate a portion of their profits to shareholders. As a result, dividend stocks can offer a combination of income and potential for capital appreciation, making them an appealing choice for a wide range of investors.

The appeal of dividend stocks lies in their ability to provide a steady income stream, which can be particularly beneficial for retirees or those seeking to supplement their income. Additionally, dividend stocks can offer a measure of stability in volatile markets, as companies with a strong track record of paying dividends are often perceived as financially sound and less prone to dramatic price swings.

- Unraveling The Impact Of The Anjali Arora Viral Mms Video

- Movierulz Kannada Movie The Ultimate Guide To Kannada Cinema

Why Invest in Dividend Stocks?

Investing in dividend stocks offers several compelling advantages for investors seeking long-term financial growth and stability. Here are some key reasons why dividend stocks are worth considering:

- Steady Income Stream: Dividend stocks provide a reliable source of income, making them an attractive option for individuals looking to generate regular cash flow. This can be particularly beneficial for retirees or those who rely on investment income to cover living expenses.

- Potential for Capital Appreciation: In addition to providing income, dividend stocks have the potential to appreciate in value. This means investors can enjoy capital gains alongside their dividend payments, enhancing their overall returns.

- Compounding Returns: By reinvesting dividends, investors can take advantage of compounding returns, which can significantly boost the value of their portfolio over time. This strategy allows investors to purchase additional shares, increasing their potential for future income and growth.

- Lower Volatility: Dividend-paying companies are often perceived as more stable and financially sound, which can result in lower volatility compared to non-dividend-paying stocks. This can provide a measure of security in turbulent markets, helping investors weather economic downturns.

- Inflation Hedge: Dividend stocks can serve as a hedge against inflation, as companies that consistently increase their dividends often do so in response to rising costs. This can help preserve the purchasing power of an investor's income over time.

Overall, dividend stocks offer a compelling combination of income, growth potential, and stability, making them a valuable component of a diversified investment portfolio. By strategically selecting dividend stocks that align with their financial goals, investors can enjoy the benefits of consistent income and long-term wealth accumulation.

Benefits of Dividend Stocks

Dividend stocks provide numerous benefits that make them an appealing choice for investors seeking both income and growth. Here are some of the key advantages of investing in dividend stocks:

- Regular Income: One of the primary benefits of dividend stocks is the regular income they provide. This can be particularly advantageous for individuals seeking a steady cash flow to meet their financial obligations or supplement their income.

- Potential for Dividend Increases: Many companies that pay dividends have a history of increasing their payouts over time. This can result in a growing income stream for investors, helping them keep pace with inflation and improve their purchasing power.

- Reinvestment Opportunities: Dividend reinvestment plans (DRIPs) allow investors to automatically reinvest their dividends to purchase additional shares. This can help compound returns and increase the overall value of an investor's portfolio over time.

- Portfolio Diversification: Dividend stocks can add diversification to an investment portfolio by providing exposure to different sectors and industries. This can help reduce risk and improve overall portfolio performance.

- Tax Advantages: In some jurisdictions, qualified dividends are taxed at a lower rate than ordinary income, providing a tax-efficient way for investors to earn income.

These benefits make dividend stocks an attractive option for investors looking to achieve a balance between income and growth. By carefully selecting dividend-paying companies with strong fundamentals, investors can enhance their portfolio's potential for long-term success.

How Do Dividend Stocks Work?

Understanding how dividend stocks work is essential for investors looking to incorporate them into their portfolios effectively. Here's a breakdown of the key components involved in dividend investing:

- Dividend Declaration: Companies that pay dividends typically announce their intention to distribute profits to shareholders through a formal declaration. This announcement includes the dividend amount, the payment date, and the record date, which is the date on which investors must own the stock to be eligible for the dividend.

- Dividend Yield: The dividend yield is a key metric used to assess the income potential of a dividend stock. It is calculated by dividing the annual dividend payment by the stock's current price, expressed as a percentage. A higher yield indicates a higher income potential relative to the stock's price.

- Ex-Dividend Date: The ex-dividend date is the date on which a stock begins trading without the right to receive the upcoming dividend. Investors who purchase the stock on or after this date will not receive the declared dividend.

- Dividend Payments: Dividends are typically paid out in cash, although some companies may offer stock dividends, where additional shares are distributed to shareholders. Dividend payments can be made on a regular basis, such as quarterly, semi-annually, or annually, depending on the company's dividend policy.

By understanding these fundamental aspects of dividend investing, investors can make informed decisions about which dividend stocks to include in their portfolios and how to maximize their income potential.

5starsstocks.com Dividend Stocks Overview

5starsstocks.com dividend stocks provide a comprehensive platform for investors to explore and invest in dividend-paying companies. This platform offers a range of resources and tools designed to help investors make informed decisions and optimize their dividend investment strategies.

Key features of 5starsstocks.com dividend stocks include:

- Curated Stock Selection: 5starsstocks.com offers a carefully curated selection of dividend stocks, focusing on companies with strong fundamentals and a history of consistent dividend payments. This helps investors identify high-quality stocks that align with their investment goals.

- Expert Insights and Analysis: Investors can access expert insights, market analysis, and research reports on dividend stocks, providing valuable information to support their decision-making process.

- Educational Resources: The platform offers a wealth of educational content, including articles, tutorials, and webinars, to help investors understand the nuances of dividend investing and develop effective strategies.

- Portfolio Management Tools: 5starsstocks.com provides portfolio management tools that allow investors to track their dividend investments, monitor performance, and make adjustments as needed to optimize returns.

With these features, 5starsstocks.com dividend stocks empower investors to make informed decisions and achieve their financial objectives through strategic dividend investing.

Choosing the Right Dividend Stocks

Selecting the right dividend stocks is crucial for building a successful investment portfolio. Here are some key factors to consider when evaluating dividend stocks:

- Dividend Yield: A higher dividend yield indicates a higher income potential, but it's important to balance yield with other factors such as company stability and growth prospects.

- Dividend History: Companies with a consistent history of paying and increasing dividends are generally more reliable and financially stable.

- Payout Ratio: The payout ratio is the percentage of earnings paid out as dividends. A lower payout ratio suggests that the company retains enough earnings for future growth and sustainability.

- Earnings Growth: Companies with strong earnings growth prospects are more likely to continue paying and increasing dividends.

- Industry and Sector: Consider diversifying your portfolio by selecting dividend stocks from different industries and sectors to reduce risk.

By carefully evaluating these factors, investors can choose dividend stocks that align with their financial goals and risk tolerance, ultimately enhancing their portfolio's potential for long-term success.

What Are the Key Metrics for Evaluating Dividend Stocks?

Evaluating dividend stocks involves analyzing several key metrics that provide insights into a company's financial health and dividend sustainability. Here are some important metrics to consider:

- Dividend Yield: The dividend yield measures the income generated by a stock relative to its price. A higher yield indicates a higher income potential.

- Payout Ratio: The payout ratio is the percentage of earnings paid out as dividends. A lower payout ratio suggests financial stability and the ability to sustain dividends.

- Dividend Growth Rate: The dividend growth rate indicates the annual rate at which a company has increased its dividends. A higher growth rate suggests a commitment to rewarding shareholders.

- Revenue Growth: Companies with consistent revenue growth are more likely to sustain and increase dividend payments over time.

- Cash Flow: Strong cash flow ensures that a company has the resources to cover dividend payments and invest in future growth.

- Debt Levels: Lower debt levels indicate financial stability and reduce the risk of dividend cuts during economic downturns.

By analyzing these metrics, investors can assess the financial health of dividend-paying companies and make informed decisions about which stocks to include in their portfolios.

Risk Management in Dividend Investing

While dividend stocks offer numerous benefits, it's essential to implement effective risk management strategies to protect your investment portfolio. Here are some tips for managing risks in dividend investing:

- Diversification: Diversifying your portfolio across different sectors and industries can reduce the impact of poor performance by individual stocks.

- Quality Over Yield: Prioritize high-quality companies with strong fundamentals over chasing high dividend yields, which may indicate financial instability.

- Regular Monitoring: Continuously monitor the performance of your dividend stocks and stay informed about any changes in the company's financial health or dividend policy.

- Risk Assessment: Assess the risks associated with each stock, including industry-specific risks and the company's competitive position.

- Exit Strategy: Have a clear exit strategy in place for underperforming stocks to minimize losses and reallocate capital to better opportunities.

By implementing these risk management strategies, investors can protect their portfolios and increase their chances of achieving long-term financial success through dividend investing.

How to Build a Diversified Dividend Portfolio?

Building a diversified dividend portfolio involves selecting a mix of dividend stocks that offer both income and growth potential while reducing risk. Here are some steps to create a well-rounded dividend portfolio:

- Define Your Financial Goals: Determine your investment objectives, risk tolerance, and time horizon to guide your portfolio construction.

- Research Potential Stocks: Conduct thorough research on dividend-paying companies, focusing on those with strong financials, consistent dividend payments, and growth potential.

- Assess Diversification Needs: Ensure your portfolio includes stocks from different sectors, industries, and geographical regions to reduce risk.

- Evaluate Dividend Metrics: Analyze key dividend metrics, such as yield, payout ratio, and growth rate, to select high-quality stocks.

- Rebalance Periodically: Regularly review and rebalance your portfolio to maintain diversification and align with changing market conditions.

- Consider Dividend ETFs: Dividend-focused exchange-traded funds (ETFs) can provide instant diversification and professional management.

By following these steps, investors can create a diversified dividend portfolio that aligns with their financial goals and enhances their potential for long-term success.

Tax Considerations for Dividend Stocks

When investing in dividend stocks, it's important to understand the tax implications that may affect your returns. Here are some key tax considerations to keep in mind:

- Qualified vs. Non-Qualified Dividends: Qualified dividends are taxed at a lower rate than ordinary income, while non-qualified dividends are taxed at the investor's regular income tax rate. Understanding the difference can help optimize your tax strategy.

- Tax-Advantaged Accounts: Consider holding dividend stocks in tax-advantaged accounts, such as IRAs or 401(k)s, to defer taxes on dividend income and capital gains.

- Foreign Dividends: Dividends from foreign stocks may be subject to foreign withholding taxes. Check if you can claim a foreign tax credit to offset these taxes.

- Dividend Reinvestment Plans (DRIPs): Reinvested dividends may still be subject to taxes, so keep track of reinvested amounts for accurate tax reporting.

- Capital Gains Tax: Selling dividend stocks at a profit may trigger capital gains tax. Be mindful of holding periods to qualify for lower long-term capital gains rates.

By understanding these tax considerations, investors can make informed decisions about how to structure their dividend portfolios to minimize tax liabilities and maximize after-tax returns.

Top 5 Dividend Stocks on 5starsstocks.com

5starsstocks.com offers a curated selection of top-performing dividend stocks that are worth considering for your portfolio. Here are the top 5 dividend stocks featured on the platform:

- Blue Chip Corp: Known for its consistent dividend payments and strong financials, Blue Chip Corp is a reliable choice for income-focused investors.

- Growth & Yield Inc: This company offers a balance of dividend income and growth potential, making it an attractive option for diversified portfolios.

- Stable Returns Ltd: With a history of increasing dividends, Stable Returns Ltd is a popular choice for investors seeking steady income.

- Dividend King Co: As a long-standing leader in dividend payments, Dividend King Co provides both stability and attractive yields.

- Income Stream PLC: Offering competitive dividend yields, Income Stream PLC is ideal for investors looking to enhance their income streams.

These top dividend stocks on 5starsstocks.com offer a compelling combination of income, growth, and stability, making them valuable additions to any dividend-focused portfolio.

Common Mistakes to Avoid in Dividend Investing

Investing in dividend stocks can be highly rewarding, but it's important to avoid common pitfalls that can undermine your investment success. Here are some mistakes to watch out for:

- Chasing High Yields: High yields may indicate financial instability or unsustainable payouts. Focus on quality companies with reasonable yields and strong fundamentals.

- Neglecting Diversification: Concentrating your portfolio in a single sector or industry increases risk. Diversify across various sectors to minimize exposure to specific risks.

- Ignoring Dividend Cuts: Be vigilant about any changes in a company's dividend policy, as cuts may signal financial troubles.

- Overlooking Growth Potential: While dividends provide income, don't neglect the growth potential of dividend stocks to achieve long-term wealth accumulation.

- Failing to Rebalance: Regularly review and rebalance your portfolio to maintain diversification and adapt to changing market conditions.

By avoiding these common mistakes, investors can enhance their chances of achieving success with dividend investing and building a robust portfolio that aligns with their financial goals.

Frequently Asked Questions

What is the best way to reinvest dividends?

Reinvesting dividends through Dividend Reinvestment Plans (DRIPs) is an effective way to compound returns. DRIPs allow investors to automatically purchase additional shares with their dividends, enhancing their potential for long-term growth.

How do dividend yields fluctuate?

Dividend yields fluctuate based on changes in the stock price and dividend payments. A decrease in stock price can result in a higher yield, while an increase in stock price can lead to a lower yield. Changes in dividend payments also affect the yield.

Are dividend stocks suitable for retirement portfolios?

Yes, dividend stocks are suitable for retirement portfolios as they provide a steady income stream and potential for capital appreciation. Retirees can benefit from the regular income generated by dividends to support their living expenses.

Can dividend stocks lose value?

Like all investments, dividend stocks can experience fluctuations in value due to market conditions, company performance, and economic factors. It's important to diversify and manage risk to protect your investment from potential losses.

What are qualified dividends?

Qualified dividends are dividends that meet specific criteria set by tax authorities and are taxed at a lower rate than ordinary income. To qualify, dividends must be paid by a U.S. corporation or a qualified foreign corporation, and the investor must meet the holding period requirement.

How often do companies pay dividends?

Most companies pay dividends on a quarterly basis, but some may choose to pay semi-annually or annually. The frequency of dividend payments is determined by the company's dividend policy and financial performance.

Conclusion

Investing in dividend stocks through platforms like 5starsstocks.com offers a wealth of opportunities for investors seeking income, growth, and stability. By understanding the intricacies of dividend investing and leveraging the resources provided by 5starsstocks.com, investors can build diversified portfolios that align with their financial goals. With careful consideration of key metrics, risk management strategies, and tax implications, dividend investors can enhance their potential for long-term success and financial security. Whether you're a novice or seasoned investor, the insights and strategies outlined in this guide will empower you to make informed decisions and thrive in the world of dividend stocks.

- Indepth Guide To Alana Chos Impact In Adult Entertainment

- Discover The World Of Desimmscom Your Ultimate Tech Hub

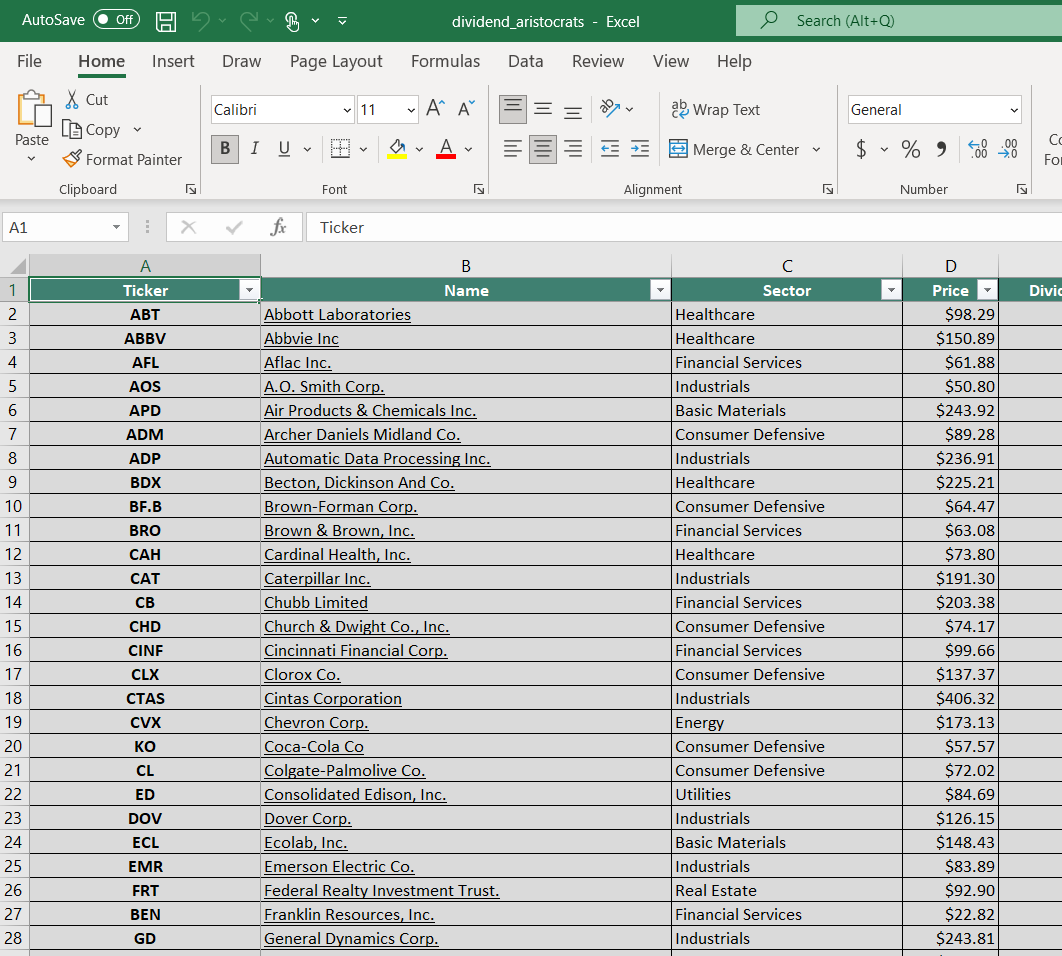

Dividend Stocks 2024 List Ardisj Caitrin

High Dividend Stocks 2024 India Winna Ludovika