Ultimate Guide To 5starsstocks.com Dividend Stocks

5starsstocks.com dividend stocks have been gaining attention among investors for their potential to provide consistent income and capital appreciation. In a world where financial security is paramount, these stocks offer a unique opportunity for both novice and seasoned investors alike to diversify their portfolios while securing regular income through dividends. With the ever-increasing need for strategic investment, understanding the nuances of dividend stocks becomes essential.

Dividend stocks are shares in companies that return a portion of their earnings to shareholders in the form of dividends. These stocks are particularly attractive to those seeking a steady income stream, as they often represent well-established companies with a proven track record of profitability. The allure of dividend stocks lies in their dual benefits: income generation and potential for capital growth. Investors looking for a balanced investment approach will find 5starsstocks.com dividend stocks to be an invaluable resource for identifying top-performing dividend-paying companies.

Investing in dividend stocks requires a thoughtful strategy and a keen understanding of the market dynamics. By leveraging the insights and resources available at 5starsstocks.com, investors can gain a competitive edge in selecting the right stocks to meet their financial goals. From evaluating dividend yields to understanding the implications of market trends, this guide will delve into the intricacies of dividend stock investment, providing a comprehensive overview for anyone looking to enhance their financial portfolio.

- Insights Into Anjali Arora Mms Videos Unveiling The Story

- All About Subhshree Xxx A Comprehensive Insight

Table of Contents

- What Are Dividend Stocks?

- How Do Dividend Stocks Work?

- Benefits of Investing in Dividend Stocks

- How to Evaluate Dividend Stocks?

- Dividend Yield vs. Dividend Payout Ratio

- Top 5starsstocks.com Dividend Stocks

- Risks Associated with Dividend Stocks

- How to Diversify Your Dividend Stock Portfolio?

- Tax Implications of Dividend Stocks

- Common Mistakes to Avoid When Investing in Dividend Stocks

- Frequently Asked Questions

- Conclusion

What Are Dividend Stocks?

Dividend stocks are shares of a company that distribute a portion of the company's earnings to shareholders in the form of dividends. These dividends are typically paid out quarterly and are a way for companies to share their profits with investors. Companies that offer dividend stocks are usually well-established and financially stable, often seen as lower-risk investments compared to non-dividend-paying stocks.

Investors are drawn to dividend stocks for their ability to provide a steady income stream, which can be particularly appealing in times of economic uncertainty. Not only do they offer the potential for regular income, but dividend stocks can also contribute to long-term capital appreciation. This combination of income and growth makes them a popular choice for both income-focused investors and those seeking a balanced investment strategy.

When considering dividend stocks, it's important to look at the dividend yield, which is the annual dividend payment divided by the stock price. A higher yield can indicate a more attractive investment, but it's crucial to assess the sustainability of the dividend payout. Companies with a consistent history of paying dividends and increasing payouts over time are often seen as more reliable choices.

- Latest Kannada Movies Movierulz Kannada New Updates

- Movierulz Kannada Movie 2024 A Comprehensive Guide To The Upcoming Releases

How Do Dividend Stocks Work?

Dividend stocks function by distributing a portion of a company's earnings to its shareholders. This distribution can be in the form of cash payments, additional shares, or other property. The process begins with the company's board of directors declaring a dividend, which is then approved and paid out on a specified date, known as the dividend payment date.

Shareholders who own the stock before the ex-dividend date are eligible to receive the dividend payment. The ex-dividend date is typically one business day before the record date, which is the cutoff for determining shareholder eligibility. It's important for investors to understand these dates as they impact the eligibility for receiving dividends.

Dividends can be reinvested back into the company through dividend reinvestment plans (DRIPs), allowing investors to purchase additional shares without incurring transaction fees. This reinvestment strategy can compound returns over time, increasing the number of shares owned and potentially leading to greater income from future dividends.

Benefits of Investing in Dividend Stocks

Investing in dividend stocks offers a range of advantages, making them an attractive option for many investors. Here are some key benefits:

- Regular Income: Dividend stocks provide a steady stream of income, which can be especially beneficial for retirees or those seeking passive income.

- Potential for Growth: In addition to income, dividend stocks can offer capital appreciation, allowing investors to benefit from rising stock prices.

- Reinvestment Opportunities: Through DRIPs, investors can reinvest dividends to purchase additional shares, compounding their returns over time.

- Portfolio Diversification: Dividend stocks can help diversify an investment portfolio, reducing risk and improving overall returns.

- Inflation Hedge: Companies that consistently increase their dividend payouts can provide a hedge against inflation, helping to preserve purchasing power.

How to Evaluate Dividend Stocks?

Evaluating dividend stocks requires a careful analysis of various factors to ensure the investment aligns with your financial goals. Here are some critical aspects to consider:

Financial Health of the Company

Assess the company's financial stability by reviewing key financial metrics such as revenue growth, earnings per share, and debt levels. A financially healthy company is more likely to sustain and increase its dividend payments.

Dividend Yield and Payout Ratio

Examine the dividend yield to understand the income potential of the stock. Additionally, evaluate the dividend payout ratio, which indicates the proportion of earnings paid out as dividends. A lower payout ratio may suggest room for future dividend growth.

Dividend History

Look for companies with a consistent history of paying and increasing dividends. A track record of stability and growth in dividend payments can be a positive indicator of future performance.

Industry and Market Trends

Consider the industry and market trends that may impact the company's ability to generate profits and pay dividends. Industries with stable demand and growth potential are generally more favorable for dividend investors.

Dividend Yield vs. Dividend Payout Ratio

Understanding the difference between dividend yield and dividend payout ratio is crucial for evaluating dividend stocks:

Dividend Yield

Dividend yield is the annual dividend payment expressed as a percentage of the stock's current price. It provides insight into the income generated by the investment relative to its price. A higher yield can be attractive, but it's important to ensure the yield is sustainable and not indicative of financial distress.

Dividend Payout Ratio

The dividend payout ratio is the percentage of earnings paid out as dividends to shareholders. It reflects the company's ability to maintain its dividend payments. A lower payout ratio may indicate a company's capacity to increase dividends, while a high ratio could suggest limited growth potential or financial strain.

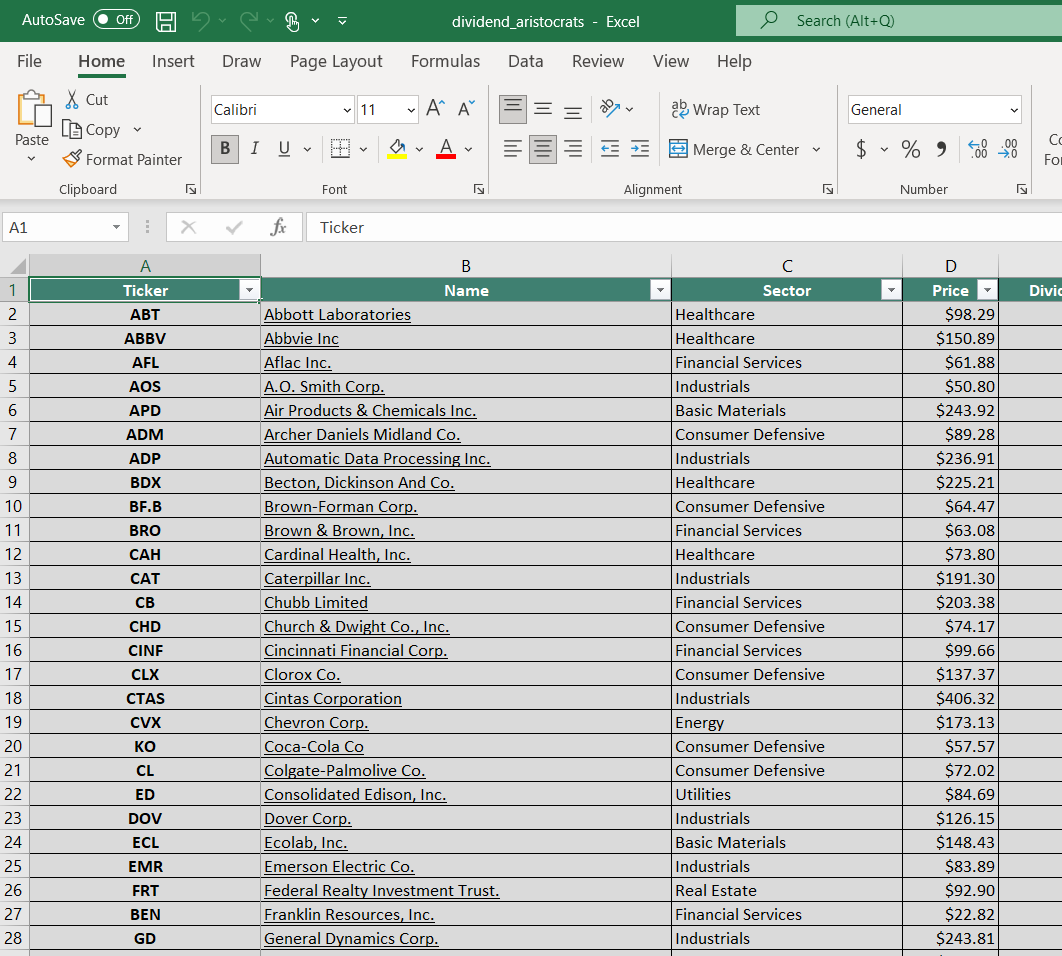

Top 5starsstocks.com Dividend Stocks

5starsstocks.com provides a curated list of top dividend stocks based on various performance metrics and financial criteria. These stocks are selected for their strong dividend yields, stable financials, and potential for future growth. Here are some notable picks:

- Company A: Known for its robust dividend history and consistent payout growth.

- Company B: Offers a competitive dividend yield with opportunities for capital appreciation.

- Company C: A leader in its industry, recognized for its financial stability and shareholder returns.

- Company D: Provides a unique blend of income and growth, appealing to diverse investor profiles.

- Company E: Renowned for its sustainable business model and commitment to increasing dividends.

Risks Associated with Dividend Stocks

While dividend stocks offer many benefits, they also come with certain risks that investors should be aware of:

Interest Rate Risk

Rising interest rates can make dividend stocks less attractive compared to fixed-income investments, potentially leading to price declines.

Market Volatility

Dividend stocks are not immune to market fluctuations, and economic downturns can impact a company's ability to maintain its dividend payments.

Dividend Cuts

Companies facing financial difficulties may reduce or eliminate dividend payments, affecting the income stream for investors.

Sector-Specific Risks

Investing in dividend stocks within a particular sector can expose investors to industry-specific risks, such as regulatory changes or shifts in consumer demand.

How to Diversify Your Dividend Stock Portfolio?

Diversification is a key strategy for managing risk in a dividend stock portfolio. Here are some tips to achieve diversification:

- Invest Across Sectors: Allocate investments across various sectors to reduce exposure to sector-specific risks.

- Include Different Company Sizes: Consider a mix of large-cap, mid-cap, and small-cap dividend stocks to capture growth opportunities and stability.

- Geographic Diversification: Include international dividend stocks to benefit from global market trends and currency fluctuations.

- Balance High and Low Yield Stocks: Combine high-yield stocks for income with lower-yield stocks that offer growth potential.

Tax Implications of Dividend Stocks

Investors should be aware of the tax implications associated with dividend stocks, as they can impact net returns:

Qualified vs. Non-Qualified Dividends

Qualified dividends are taxed at a lower capital gains rate, while non-qualified dividends are subject to ordinary income tax rates. Understanding the difference can help optimize tax efficiency.

Tax-Advantaged Accounts

Consider holding dividend stocks in tax-advantaged accounts such as IRAs or 401(k)s to defer taxes on dividends and capital gains.

Foreign Dividend Tax

Investors in international dividend stocks may face foreign withholding taxes, which can sometimes be offset through tax credits or deductions.

Common Mistakes to Avoid When Investing in Dividend Stocks

Investing in dividend stocks requires careful consideration to avoid common pitfalls. Here are some mistakes to watch out for:

- Chasing High Yields: High dividend yields can be tempting, but they may indicate underlying financial issues. Evaluate the sustainability of the yield.

- Neglecting Diversification: Failing to diversify a dividend stock portfolio can increase risk and limit potential returns.

- Overlooking Company Fundamentals: Prioritize companies with strong financial health and growth prospects rather than focusing solely on dividends.

- Ignoring Tax Implications: Be mindful of the tax treatment of dividends and strategize to optimize after-tax returns.

Frequently Asked Questions

What are the best sectors for dividend stocks?

Sectors such as utilities, consumer goods, and healthcare are known for offering stable dividend stocks due to their consistent demand and reliable cash flows.

How often are dividends paid?

Dividends are typically paid quarterly, but some companies may pay them monthly, semi-annually, or annually, depending on their dividend policy.

Can dividend stocks lose value?

Yes, like all stocks, dividend stocks can lose value due to market fluctuations, economic downturns, or company-specific issues.

How can I start investing in dividend stocks?

Begin by researching and selecting dividend stocks that align with your investment goals, then invest through a brokerage account or dividend mutual fund.

What factors affect dividend payments?

Factors such as company profitability, cash flow, and management's dividend policy can impact the ability to pay and increase dividends.

Are dividends guaranteed?

No, dividends are not guaranteed. Companies can reduce or eliminate dividends due to financial challenges or strategic decisions.

Conclusion

Investing in 5starsstocks.com dividend stocks offers a unique opportunity to achieve financial stability through a combination of income and growth. By understanding the mechanics of dividend stocks, evaluating key metrics, and diversifying your portfolio, you can harness the full potential of dividend investing. While there are risks involved, informed decision-making and strategic planning can mitigate these challenges and enhance your investment journey. Whether you're a seasoned investor or just starting, 5starsstocks.com provides invaluable resources to guide you in building a rewarding dividend stock portfolio.

For further insights and a comprehensive list of top-performing dividend stocks, visit 5starsstocks.com.

- Kannada Movie Rulz Com Your Gateway To The World Of Kannada Cinema

- Unraveling The Anjali Arora Viral Mms Phenomenon

High Dividend Stocks 2024 India Winna Ludovika

High Dividend Yield Stocks 2025 Carl Morrison